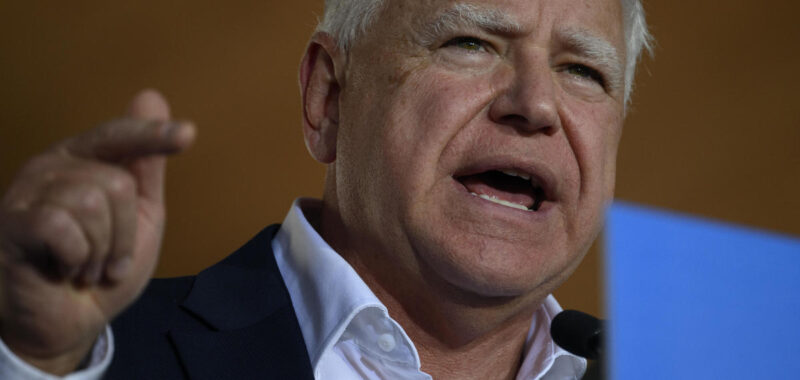

Minnesota Gov. Tim Walz may be best known for his Midwestern roots, having grown up in Nebraska and spent years as a public school teacher and football coach in Minnesota. But voters will get a chance during his debate Tuesday with vice presidential rival Sen. JD Vance on CBS to hear more about Walz’s views on the economy, a critical issue in the November election.

With polls pointing to a tight 2024 presidential race, the share of voters who describe the economy as good has inched up, helping lift support for the Democratic ticket of Vice President Kamala Harris and Walz. Yet almost 6 in 10 voters describe the economy as “bad,” CBS News polling shows, with the economy ranking as the most important issue among likely voters.

Already, Walz’s approach toward economic issues is visible through his actions as governor of Minnesota, a job he’s held since 2019 and where he is now serving his second term. His policies have included enacting the largest state Child Tax Credit in the nation and enacting free school meals for the state’s K-12 students, while raising taxes on high earners in the state to help pay for those and other social programs.

Walz “has added to the progressivity of Minnesota’s tax code,” noted Carl Davis, research director at the Institute on Taxation and Economic Policy (ITEP), a left-leaning think tank. “Having a system like Minnesota’s, where you ask more of folks at the top, that type of progressive system makes it a whole lot easier to pay for spending on side initiatives like free school lunch.”

The taxes and social programs that Walz signed into law in Minnesota echo some of the plans that the Harris-Walz ticket have so far rolled out, including a more generous federal Child Tax Credit and plans to increase taxes on higher earners and corporations.

“The parallels are pretty obvious” between Walz’s track record in Minnesota and the Harris-Walz national campaign, Davis said.

Minnesota’s Child Tax Credit

A number of states enacted or expanded a Child Tax Credit following the pandemic, when the federal government boosted the national CTC to as much as $3,600 per child. That bigger benefit was credited with helping reduce child poverty to historic lows, but when that enhanced CTC expired in 2022, child poverty rates surged.

That prompted some states, including Minnesota, to explore enacting their own CTCs, ITEP’s Davis noted.

Minnesota’s CTC of $1,750 per child is the most generous state child tax credit in the U.S., according to the Tax Policy Center, a tax-focused think tank. Walz touted it as “the best child tax credit in the country” and encouraged Minnesota parents to file their taxes in order to claim the benefit.

Vance, meanwhile, has proposed expanding the federal CTC to $5,000, but Republican lawmakers earlier this year blocked a modest expansion in the tax benefit. Vance didn’t vote on the failed Senate bill to provide a bigger CTC to low-income families, as he wasn’t present for the vote. He told “Face the Nation” in August that the vote was for “show” and destined to fail, regardless of the direction of his vote.

The debate on Tuesday is likely to pit Walz’s ideas for how to help families afford the rising cost of living against Vance’s economic views, which aside from expanding the CTC have included criticizing Democrats as “anti-family.”

Lowering Social Security taxes

Walz has also sought to help Minnesota residents on the other end of the age spectrum — retirees. As part of the state’s 2023 tax bill, Walz eliminated Minnesota income taxes on Social Security benefits for three-quarters of beneficiaries.

Under the Minnesota law, couples with annual income of less than $100,000 and single filers earning less than $78,000 are now exempted from state taxes on their Social Security checks.

Scrapping taxes on Social Security benefits has also been proposed by former President Donald Trump, who earlier this year vowed to eliminate federal income tax on the monthly government payments. About 40% of the nation’s 67 million Social Security recipients earn enough from their benefits to owe taxes to the IRS.

But there’s one major difference between the dueling proposals: Walz paid for his cuts to Social Security taxes — as well as the CTC — by raising taxes on higher-income households, according to the Tax Policy Center. Trump and Vance, meanwhile, have indicated they want to lower taxes on corporations and renew the tax cuts in the 2017 Tax Cuts & Jobs Act, which gave the most generous tax cuts to higher earners.

Walz accomplished his tax cuts for families and seniors by limiting the amount of standard or itemized deductions that high-income filers could claim, as well as reducing a deduction for dividend income and creating a surtax on capital gains income, the Tax Policy Center notes.

How does Minnesota’s economy compare?

Minnesota’s gross domestic product has expanded about 5% since 2018, when Walz was elected governor, according to the Minnesota Compass, a data site created by Wilder Research, a Minnesota-focused research group that focuses on topics such as homelessness and public health.

Since the height of the pandemic, when employers cut workers across the nation, Minnesota has regained its lost jobs and is now back to where it was before the health emergency, its data shows.

Minnesotans also earn more than the typical American worker, with median income in the state of $85,000 in 2023, compared with about $78,000 nationally, Minnesota Compass found. To be sure, Minnesota residents’ incomes have paced ahead of the U.S. median for at least three decades, long predating Walz’s election, the data shows.

The state ranks highly for doing business, with one recent study from business news site CNBC ranking it No. 6 among the 50 U.S. states based on a number of criteria, including competitiveness, workforce, infrastructure, economy, quality of life and business friendliness.

A number of businesses have recently planned expansions or investments in Minnesota, including a $5 billion expansion from the Mayo Clinic and a historic $525 million investment from Polar Semiconductor.

The state’s relatively strong economy also helped generate enough tax revenues to provide surpluses at the start of the 2019 and 2021 budget cycles, as well as an enormous $17.6 billion budget surplus for 2023. The latter helped the state fund the ambitious social programs signed into law by Walz, which include free school meals for children.

—With reporting by the Associated Press.