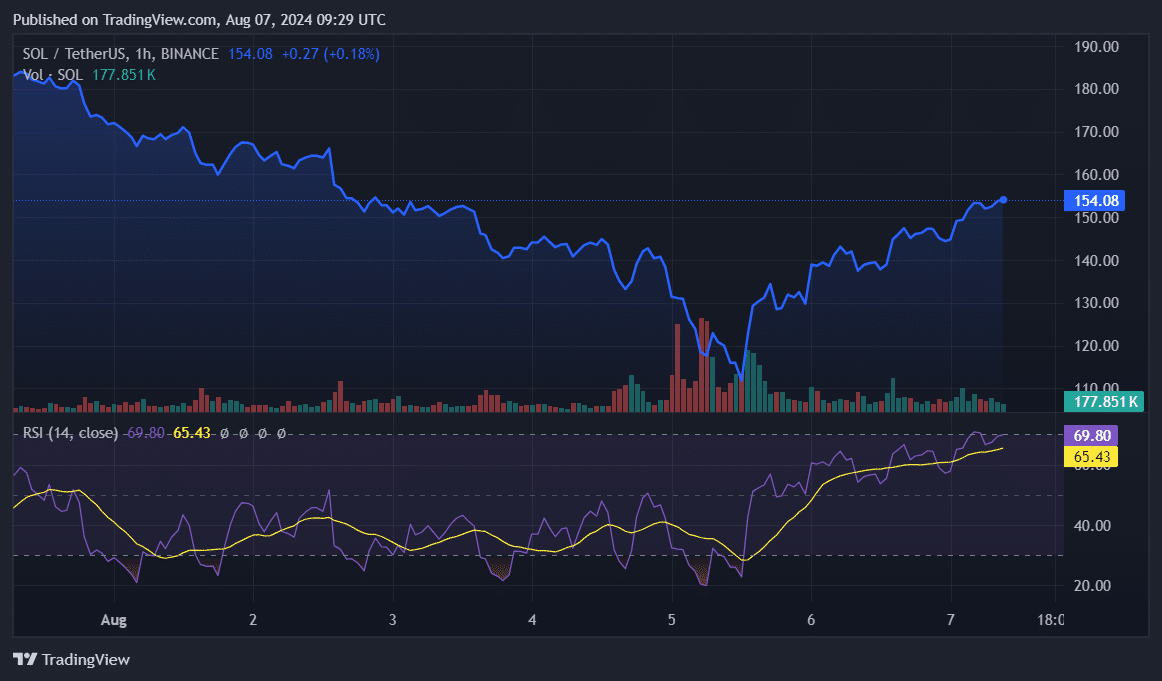

Solana has been moving strong after the market-wide bearish momentum on Aug. 5. The fifth-largest cryptocurrency entered the $150 zone again.

Solana (SOL) is up 12% in the past 24 hours and is trading at $154 at the time of writing. The asset’s market cap is sitting at $71.8 billion with a daily trading volume of $5.5 billion.

So far, SOL has registered a 40% price rally from its local bottom of $110 on Aug. 5 and strengthened its position after retesting the $140 mark.

The asset’s price surge comes as discussions about Solana heat up. According to data provided by Santiment, the social volume around SOL increased by 30% over the past two days, making it the top trending token on social media platforms.

Data shows that the majority of the social volume comes from X and Telegram.

Per data from the market intelligence platform, the total open interest in Solana increased by 18% over the past 24 hours — rising from $1.44 billion to $1.69 billion. This shows increased trader interest in Solana as the price rebounds.

Data shows that the total funding rate aggregated by SOL plunged into the negative zone again — dropping from 0.0007% to negative 0.002% over the past 24 hours. This shows that the number of trades betting on Solana’s price fall is slightly dominating long positions.

Historically, Solana witnessed a quick rebound after its funding rates dropped below zero.

According to crypto.news data, the Solana Relative Strength Index is currently hovering at the 65 mark. The indicator shows that SOL is slightly overbought at this price point.

Solana is currently vulnerable to high price volatility due to its increased open interest, which could ultimately trigger liquidations, and heightened RSI.

It’s important to note that macroeconomic and political events could have a sudden impact on financial markets, including cryptocurrencies, despite bullish technical indicators.