Insights from Oaktree Capital’s Latest 13F Filing for Q2 2024

Howard Marks (Trades, Portfolio), the chairman of Oaktree Capital Management LP, has made significant adjustments to his investment portfolio in the second quarter of 2024. Oaktree, known for its focus on alternative investments and debt markets, reflects Marks’ strategic decisions in the latest 13F filing. His expertise in less efficient markets and his investment philosophy are evident in the recent changes to the portfolio.

New Additions to the Portfolio

Howard Marks (Trades, Portfolio) has expanded his portfolio by adding four new stocks in this quarter:

-

Liberty Global Ltd (NASDAQ:LBTYA) leads the new entries with 3,801,637 shares, making up 1.15% of the portfolio, valued at $66.26 million.

-

Trip.com Group Ltd (NASDAQ:TCOM) follows with 585,645 shares, representing 0.48% of the portfolio, totaling $27.53 million.

-

Gerdau SA (NYSE:GGB) was also added with 5,888,855 shares, accounting for 0.34% of the portfolio, valued at $19.43 million.

Significant Increases in Existing Positions

Howard Marks (Trades, Portfolio) has also increased his stakes in 17 existing stocks, with notable increases in:

-

Star Bulk Carriers Corp (NASDAQ:SBLK), where an additional 1,858,443 shares were purchased, bringing the total to 7,966,426 shares. This adjustment increased the share count by 30.43%, impacting the portfolio by 0.79%, with a total value of $194.22 million.

-

Indivior PLC (NASDAQ:INDV) saw an addition of 1,141,937 shares, bringing the total to 4,493,173 shares. This represents a 34.08% increase in share count, valued at $70.43 million.

Complete Exits from Certain Holdings

In the second quarter of 2024, Howard Marks (Trades, Portfolio) decided to exit completely from 10 holdings, including:

-

ICICI Bank Ltd (NYSE:IBN), selling all 2,851,796 shares, which had a -1.3% impact on the portfolio.

-

Eagle Bulk Shipping Inc (EGLE), where all 1,098,819 shares were sold, impacting the portfolio by -1.18%.

Reductions in Key Holdings

Reductions were made in 13 stocks, with significant cuts in:

-

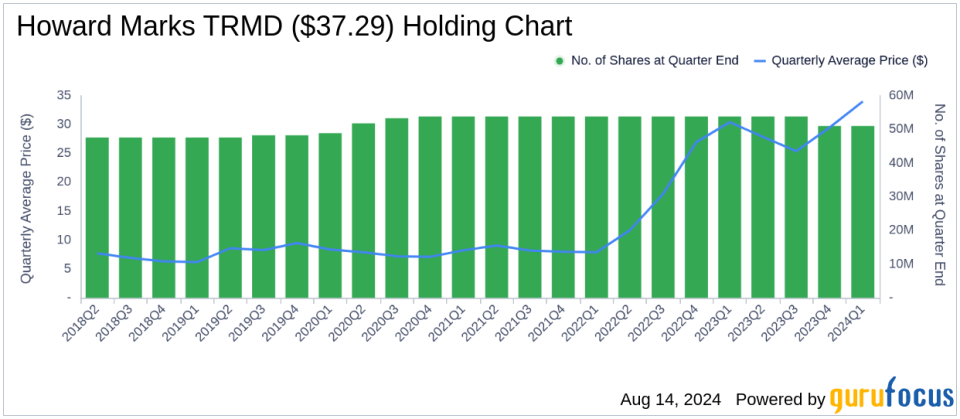

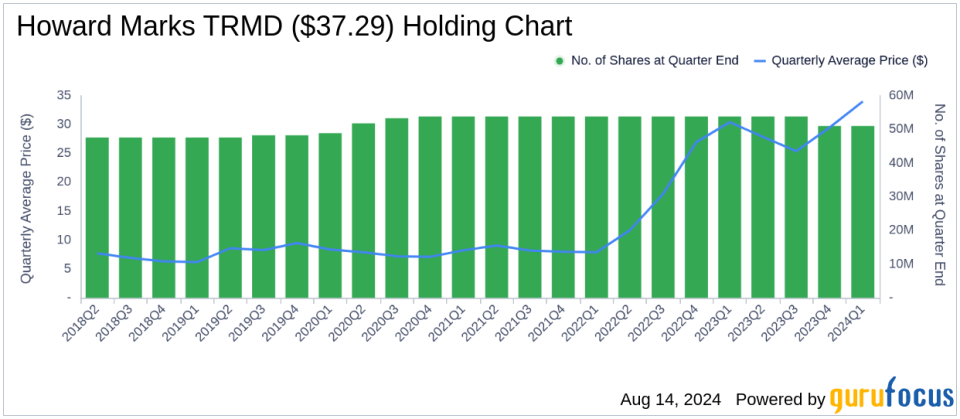

TORM PLC (NASDAQ:TRMD), where 6,896,552 shares were sold, resulting in a -13.52% decrease in shares and a -4.03% impact on the portfolio. The stock traded at an average price of $35.81 during the quarter and has seen a return of 2.22% over the past three months and 33.62% year-to-date.

-

Runway Growth Finance Corp (NASDAQ:RWAY) saw a reduction of 4,712,500 shares, a -30.42% decrease, impacting the portfolio by -0.99%. The stock’s average trading price was $12.15 during the quarter, with a -9.33% return over the past three months and -8.67% year-to-date.

Portfolio Overview and Sector Allocation

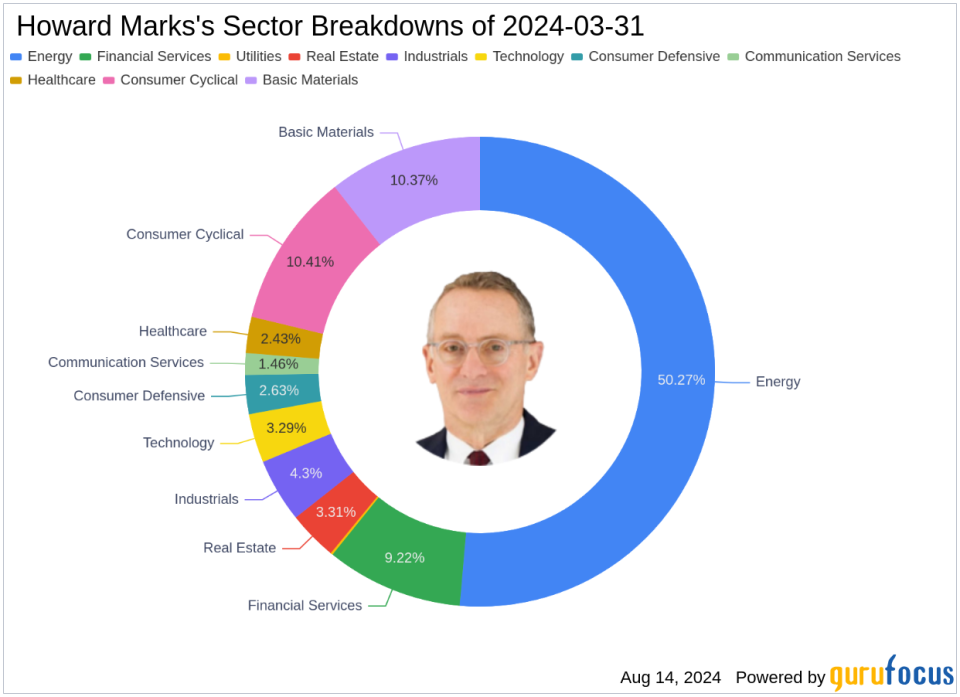

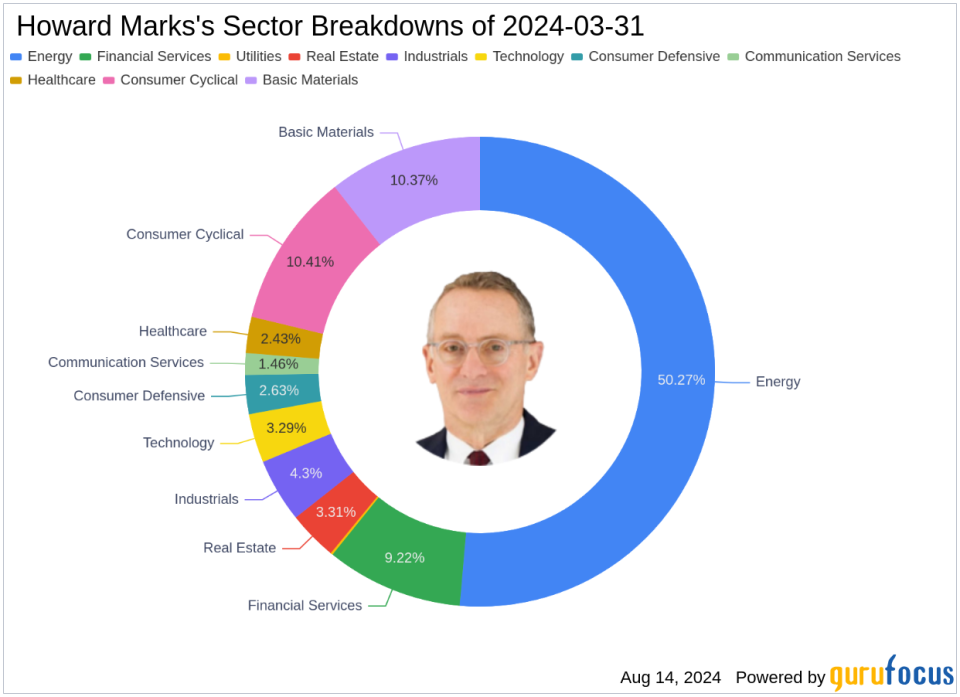

As of the second quarter of 2024, Howard Marks (Trades, Portfolio)’s portfolio includes 55 stocks. The top holdings are heavily concentrated in TORM PLC (NASDAQ:TRMD) at 30.05%, Chesapeake Energy Corp (NASDAQ:CHK) at 9.84%, and Garrett Motion Inc (NASDAQ:GTX) at 6.6%. Other significant holdings include Sitio Royalties Corp (NYSE:STR) and Star Bulk Carriers Corp (NASDAQ:SBLK).

The portfolio spans across various industries, maintaining a diverse sector allocation that includes Energy, Basic Materials, Consumer Cyclical, and more, reflecting a strategic distribution across 11 different sectors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.