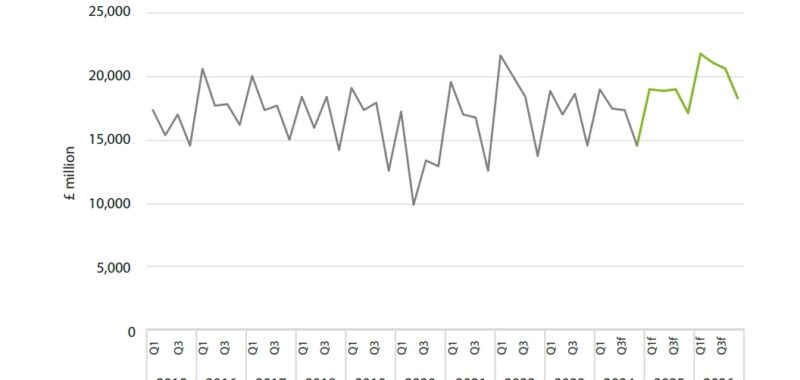

Glenigan’s UK Construction Industry Forecast 2025-2026 forecasts 8% growth in construction output in 2025 and 10% growth in 2026.

According to Glenigan, project-starts have stabilised since the general election in July and private sector work has gradually risen. Main contract awards are 7% up on 2023 figures, supporting a renewed rise in industrial and office starts as investor confidence improves.

While some commentators think the recent budget will have a negative impact on construction growth, Glenigan’s economic director Allan Wilen is not one of them. He said: “The construction sector is on track for growth from 2025, fuelled by a combination of improved consumer confidence, increased household spending, and strategic fiscal changes announced in the recent budget. These factors are set to drive activity in consumer-related verticals such as private housing, retail, and hotel & leisure.

“The budget’s adjustments to fiscal rules, allowing for higher levels of capital investment, will also unlock significant public sector and infrastructure projects, providing a much-needed boost to government-funded initiatives over the next two years.”

He predicts that private housing starts will increase in value by 13% in 2025 and a further 15% in 2026. This is after falls of 10% in 2023 and 5% in 2024.

However, after growing by 26% in value this year, civil engineering starts will rise by a more modest 5% next year and 7% in 2026, Glenigan predicts.

Industrial starts, which enjoyed a strong rebound post-pandemic, fell back sharply in 2023 and weakened further in 2024.

Nonetheless, industrial starts are forecast to return to growth over the next two years. A stronger economic outlook is expected to drive online retail, encouraging a demand revival for premises next year with a 5% predicted growth in 2025, and 8% in 2026.

Although planning approvals fell back this year, there is a strong pool of previously approved projects that developers and investors can take forward over the next two years, in response to the resurging demand for industrial floorspace.

The retail construction sector has faced significant challenges, including weak consumer demand, rising costs, and the ongoing shift toward online sales. These factors have contributed to a substantial decline in project start values and detailed planning approvals in recent years.

However, a revival in consumer spending is anticipated to support a gradual recovery in the sector. Project-starts are expected to see steady growth, with Glenigan forecasting a 14% increase in the near term, followed by a 1% rise in 2025, and 9% in 2026.

Investment by the deep discount supermarkets, Aldi and Lidl, is set to be a bright spot within the sector over the forecast period, as plans to substantially expand their estates boost growth.

Health starts rebounded by 11% this year, reversing the 8% decline during 2023 as NHS resources were redirected toward addressing long waiting lists and resolving industrial unrest.

While the NHS remains a priority for the government, a 17% decline in detailed planning approvals during the first nine months of 2024 may limit new projects in the near term.

However, increased funding should boost healthcare projects over the forecast period.

The chancellor has announced a 15% increase in NHS capital funding for 2025/26 to address building maintenance, RAAC repairs as well new diagnostic equipment. This increase is expected to support a modest rise in project starts in 2025 (+1%), alongside continued progress on the new hospital programme.

Sector growth is expected to strengthen in 2026 (+10%), with the government’s long-term spending plans to be outlined in the spring spending review.