Skift Take

Timely commissions form a critical foundation for productive partnerships between hotels and travel agencies. Deploying the fastest, most reliable funding methods reduces administrative workloads and banking fees and also improves supplier-vendor relationships.

This sponsored content was created in collaboration with a Skift partner.

In the competitive hospitality industry, timely commissions are not merely a financial detail. Travel management companies (TMCs) often cite âdays to payâ as a KPI when evaluating their relationships with hotel partners. Timely funding from hotels ensures that TMCs can operate without cash flow interruptions, fostering trust and reducing financial stress.

According to Skift Research, the hotel sector accounts for the largest percentage of total consumer travel spending, which also makes it the vertical with âthe largest and most opportunistic commission pool available.â Understanding the importance of expedited commission payments is key to fostering more productive and beneficial supplier-vendor partnerships in this space.

Most Frequent Funding Methods for Commissions Distribution

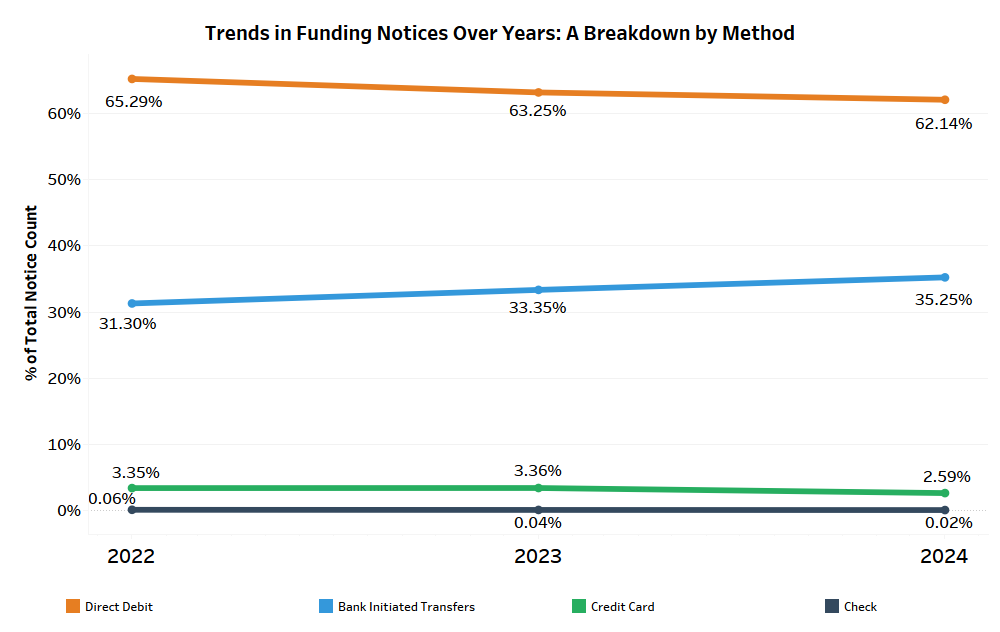

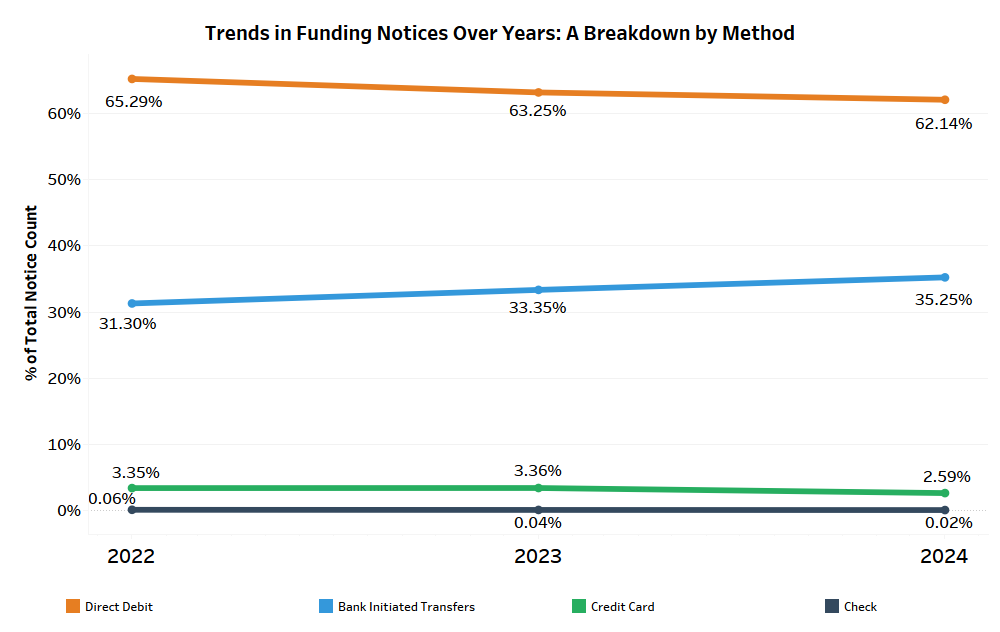

Hotels employ various funding methods to disburse commissions. However, according to OnyxInsights data from 2022 to 2024, the vast majority come from direct debit or bank-initiated transfers, which include wire deposits.

Though direct debit has consistently been the predominant funding method for commissions, its share has slightly declined from 65 percent in 2022 to 62 percent in 2024, driven primarily by cash-control measures initiated following the Covid-19 pandemic, while bank-initiated transfers have gained traction, increasing from 31 percent to 35 percent in the same period.

Why Direct Debit Is Preferred for Faster Funding

Each funding method has unique attributes. Bank transfers are beneficial because theyâre secure and reliable, which helps explain why 90 percent of travel executives said their companies use them in some capacity, according to a March 2024 survey of global travel executives from Skift and Airwallex.

However, time to pay can be unpredictable with bank transfers, primarily because they must be manually initiated. That means theyâre subject to national holidays and other bank-specific schedules, which can be particularly impactful on timely commissions for companies with a lot of international payments.

Moreover, direct debit streamlines the entire payment process, reducing the time and effort required to initiate transactions. This efficiency not only cuts down on the administrative workload but also results in lower banking fees. Direct debit benefits are not just about speeding up payments, they can also optimize financial operations to support scalable growth and improve overall business agility.

Each of these factors is critically impactful: According to the Skift and Airwallex study, 70 percent said that their organizations lose significant amounts of time reconciling financial information across countries and markets.

Using Analytics to Better Understand the Commissions Lifecycle

Persistent issues with unfunded or delayed commissions from hotels can severely strain relationships with agencies. Regular occurrences of such issues may prompt agencies to reconsider their partnerships, which could potentially impact a hotel’s reputation and its ability to secure future business. Or, agencies could use lags in payment as leverage in contract renewals and negotiations. Managing these issues can be a significant administrative burden, further complicating the situation and diverting resources from other critical operational areas.

Alongside consistent, predictable commission transactions, detailed analytics enable hotels and TMCs to precisely measure average days to payment with industry-wide benchmarks, ensuring stakeholders can make informed, strategic decisions based on comprehensive, real-time data.

Choosing the right funding method can drastically improve time to payment, but itâs not the only impactful factor on timely commissions. Onyx CenterSource data indicates that by adopting recommended funding structures, hotels can reduce their time to payment by almost 40 percent, from 58 days to 35 days.

Coming next month: Learn how to turn these insights into real results. Septemberâs edition of âThe Data Snapâ will build on this topic and examine how organizational frameworks enable more efficient and seamless funding processes, adding another page to the playbook for better hotel-agency partnerships.

âThe Data Snapâ is a monthly article series that paints a clearer picture of the dynamic hotel booking landscape, empowering hotels and agencies to make data-driven decisions that help them build productive partner relationships and drive more revenue.

OnyxInsights offers a comprehensive view of the industry landscape, enabling hotels and TMCs to make well-informed decisions and better serve their clients and partners. Onyx CenterSource processes over 100 million transactions annually on behalf of 200,000 agencies and 150,000 hotels globally, representing nearly $2.1 billion in hotel commission payments. Visit onyxcentersource.com to learn more.

This content was created collaboratively by Onyx CenterSource and Skiftâs branded content studio, SkiftX.