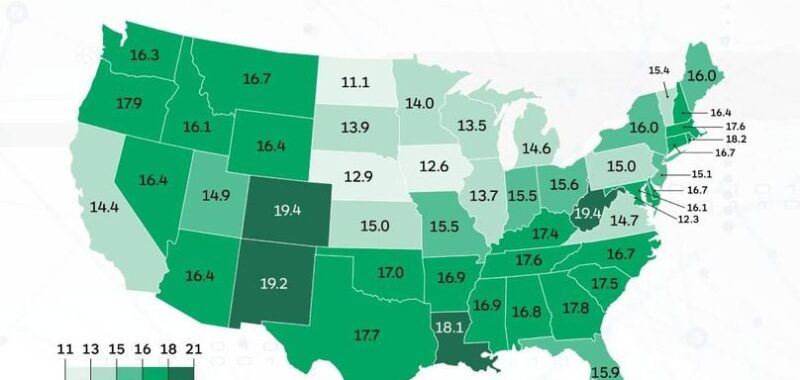

Alaska had the highest overall LOR in Q2 2024 at 20.7 days, followed by Colorado and West Virginia, both at 19.4 days. New Mexico was right behind at 19.2 days. North Dakota had the lowest LOR at 11.1 days, with Washington, D.C. at 12.3 days and Iowa at 12.6 days. Montana had the largest LOR drop, down 3.1 days from Q2 2023 to 16.7. Washington was close behind, recording a drop of 2.9 days to 16.3. Only West Virginia had an LOR increase in Q2 2024 compared to Q2 2023, up one-half day to 19.4 days. Maine was the only state to have flat LOR results at 16 days.

Graphic: Enterprise Rent-A-Car

Overall length of rental (LOR) for collision-related rentals in Q2 2024 was 16 days, a 1.4-day decline from Q2 2023, according to a quarterly LOR report released Aug. 5 by Enterprise Rent-A-Car.

Traditionally, LOR continues a decrease from Q1 into Q2, with June seeing an increase. As Enterprise observed in Q1 2024, that trend continues, although the traditional June rise did not occur in 2024.

“As Q2 2024 started, there was a significant decline in the average backlog of work in shops nationwide,” said John Yoswick, editor of the weekly CRASH Network newsletter, in a news release.

Repair Backlogs Down Sharply

Backlogs always drop from Q1 to Q2 each year, typically by two or three days. This year, however, backlog plummeted by nearly nine days in the second quarter — the largest decline in backlog since the 10-day drop in the second quarter of 2020 (at the start of the pandemic lockdowns).

With this quarter’s drop of 8.8 days, the average scheduling backlog of 2.7 weeks is now more than three weeks shorter than the high of 5.8 weeks reached in the first quarter of 2023.

“That said, a 2.7-week average remains higher than any quarter prior to mid-2021, and nearly double the historical second quarter average of 1.4 weeks,” Yoswick added. “Backlogs typically rise from Q2 to Q3 each year, so if the decline continues this summer, that will be surprising.”

Greg Horn, PartsTrader’s chief industry relations officer, explained that PartsTrader uses median delivery days (plus two standard deviations) to track the delivery times and the impact of the outliers that can cause repair delays and increase length of rental.

“Median delivery days for all part types decreased by 2.4 days when comparing Q2 2023 to Q2 2024, aligning with a reduction in rental days shown in Enterprise data,” Horn said in the release. “In looking specifically at June data, median delivery days did not show the traditional ‘June bump’, which is also in alignment with Enterprise data. We are seeing the collision parts ecosystem working well, having recovered from issues at the West Coast shipping ports and the UAW strike in 2023.

“However, a situation to monitor is the potential of an East Coast and Gulf Coast dock strike this year,” he added. Hopefully, a deal can be reached to avoid any work stoppages.”

Drivable, Non-Drivable, and Total Loss LORs

In more related Q2 data:

- Drivable LOR: 14.6 days, a 0.9-day drop from Q2 2023’s 15.5 days. While this drop seems significant, it’s also important to compare 2021 and 2022 results for additional context. In Q2 2022, LOR with rentals associated with drivable claims was 15.2 days, which was a 3.7-day increase from Q2 2021’s result of 11.5 days. So, comparing Q2 2024 to Q2 2021, drivable LOR has increased 3.1 days.

- Non-Drivable LOR: 22.4 days, a 3.2-day decrease from Q2 2023. While a big decrease from Q2 2023’s high water mark, comparing these results to Q2 2021 is also relevant. In Q2 2021, non-drivable LOR was 18.7 days, or 3.7 days lower than this quarter’s results.

- Total Loss LOR: LOR for rentals associated with a total loss claim was 14.7 days, down 1.8 days from Q2 2023. Vermont had the highest total loss LOR at 19.2 days, followed by Hawaii (18.9) and West Virginia (17.9). South Dakota had the lowest LOR at 11.6 days. North Dakota (12.3) and Nebraska (12.9) had the next-lowest total loss LORs.

“We’re also seeing some other signs that the pace of work coming into shops has slowed in recent month,” Yoswick said. Shops’ revenue expectations for 2024, based on the first five months of the year, hit a four-year low in June, according to our quarterly survey.”

More than half (54%) of about 400 responding shops said they expected revenues to be higher this year compared to last, including 33% who expected an increase of 10% or more. But that was down from the same survey’s findings in the 2Q 2023 (when 83% expected higher year-over-year revenues), and down from the same period in 2022 (79%) and 2021 (66%). Nearly one in three shops (31%) expect 2024 revenues to fall short of the prior year, more than three times the number that thought that in the second quarter of 2022 and 2023, Yoswick reported.

Ryan Mandell, director of claims performance for Mitchell International, observed: “In the U.S., total loss frequency increased in Q2 2024 to 19.8%, which is up from 18.5% in Q2 2023. As vehicle values continue to decline, we expect total loss frequency to gradually increase as well, especially with severity gains not showing any signs of abating. With more vehicles being written off, the higher dollar repairs are no longer flowing into repair facilities, and overall repairable volumes will decline, creating fewer bottlenecks and delays in repair facilities.”

In conclusion overall, Yoswick noted: “Shops may be working through their backlog more quickly than they did in recent years because of successful hiring.”

There were 99,540 body technicians employed in the industry by mid-2023, an increase of more than 8,000 in just one year, according to the Department of Labor.